Purchasing a new car is an exciting milestone, and the Scotiabank new car loan Canada offers a reliable way to finance your dream vehicle. With competitive interest rates, flexible repayment options, and accessibility at over 4,000 dealerships across Canada, Scotiabank makes car ownership achievable for many. Whether you’re a first-time buyer, a recent graduate, or a newcomer to Canada, this loan is designed to fit various financial needs.

This article provides an in-depth look at the loan’s features, including rates, eligibility, application processes, and unique benefits like financing for electric vehicles. For general car financing insights, the Financial Consumer Agency of Canada offers valuable information at their website. To explore financing options further, visit Quick Approvals Canada.

Overview of Scotiabank New Car Loan Canada

Scotiabank, one of Canada’s “Big Five” banks, provides a robust auto loan program for new and used vehicles up to 7 years old. The Scotiabank new car loan Canada allows borrowing up to $200,000 with terms extending to 8 years (96 months), offering flexibility for different budgets. Key features include:

- Loan Amount: Up to $200,000, covering most new car purchases.

- Vehicle Age: New or up to 7 years old, ensuring broad vehicle eligibility.

- Loan Term: 12 to 84 months, with longer terms reducing monthly payments.

- Interest Rates: Fixed or variable, starting at 6.99% for new cars.

- Payment Options: Weekly, bi-weekly, or monthly, with the ability to adjust frequency or amount.

- Prepayment Flexibility: Pay off early or make extra payments without penalties.

- Payment Break: Postpone one payment per year for financial flexibility.

- Dealership Access: Available at over 4,000 Canadian dealerships.

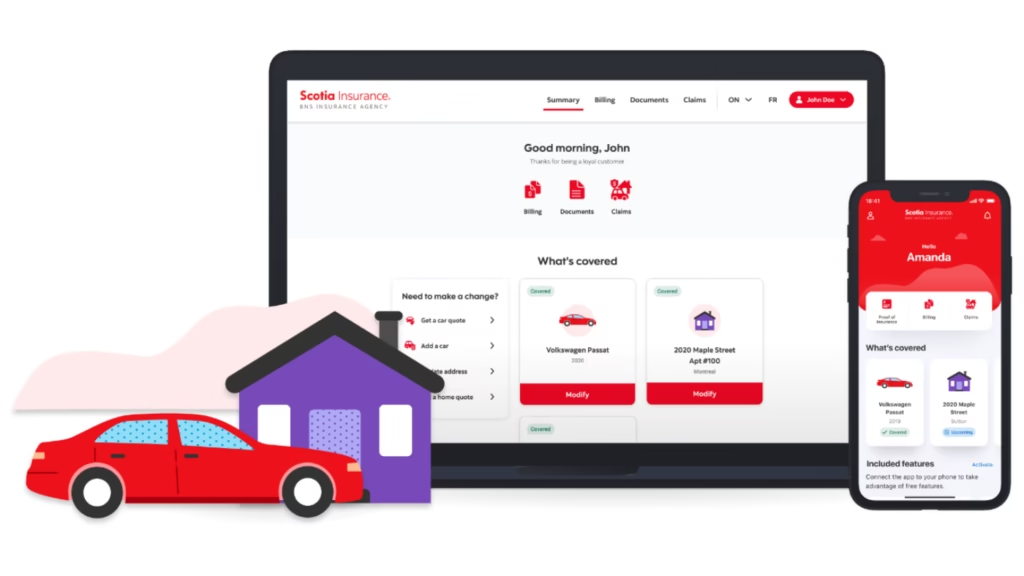

- Online Management: Monitor balances, due dates, and make changes via Scotiabank’s online platform.

- Loan Protection: Optional Scotia Loan Protection for unexpected events like job loss or illness.

This comprehensive package makes Scotiabank a top choice for car financing, as noted by its ranking as the #1 dealership financing option in Canada.

Understanding Scotiabank New Car Loan Rates Canada

Interest rates significantly affect the cost of a car loan. For Scotiabank new car loan rates Canada, new car loans start at 6.99%, while used car loans begin at 7.99%. Rates vary based on credit score, loan amount, term, and vehicle age. For used cars, rates are:

| Loan Term (Months) | Interest Rate Range (OAC) |

|---|---|

| Less than 78 | 6.99% – 10.49% |

| 84 | 8.44% – 11.24% |

| Over 84 | 8.93% – 11.73% |

For Scotiabank auto loan interest rates 2025, these figures are current as of July 2025 but may change. Borrowers with credit scores in the low 700s typically secure the lowest rates, while scores in the mid-600s may qualify at higher rates. Scotiabank’s auto loan calculator, available on their website, helps estimate payments. For example, a $30,000 loan with a 20% down payment over 60 months at 6.99% yields approximately $450 monthly. Fixed rates offer stability, while variable rates may save money if market rates drop, though they carry some risk.

How to Apply for Scotiabank Car Loan Online

Applying for a Scotiabank new car loan Canada is straightforward, with options to apply online, by phone, or at a dealership. The online process is particularly convenient:

- Visit Scotiabank’s auto loan page.

- Click “Apply Now” and complete the form with personal and financial details.

- Submit the application for review, typically processed within 1-3 business days.

- Receive a pre-approval letter valid for 30 days, if approved.

For Scotiabank car loan pre approval, the process is similar, providing confidence to shop within your budget. In-person applications at Scotiabank branches or dealerships are also available, with same-day approval possible at branches. To streamline your application, visit Quick Approvals Canada for additional resources and support.

Meeting Scotiabank Car Loan Requirements for New Cars

Eligibility for Scotiabank new car loan Canada includes:

- Residency: Must be a Canadian resident.

- Income: Stable income, verified by pay stubs or bank statements.

- Credit Score: Recommended minimum of 680 for optimal rates; mid-600s may qualify at higher rates.

- Documents: Driver’s license, proof of income, proof of address, vehicle details, and insurance information.

Self-employed applicants need financial statements, tax returns, and bank statements. Recent bankruptcies (less than 2 years old) may complicate approval. Scotiabank’s flexible criteria accommodate various financial profiles, including newcomers and graduates.

Benefits of Choosing Scotiabank New Car Loan Canada

The Scotiabank new car loan Canada offers numerous advantages:

- Payment Flexibility: Adjust payment frequency, amount, or timing to suit your budget.

- No Prepayment Penalties: Pay off early to save on interest.

- Annual Payment Break: Postpone one payment per year for financial relief.

- Dealership Convenience: Finance directly at over 4,000 dealerships.

- Online Tools: Manage your loan online, checking balances or making extra payments.

- Electric Vehicle Financing: Scotiabank car loan for electric vehicles supports eco-friendly purchases, potentially with special rates or incentives.

- Loan Protection: Optional coverage for unexpected events like disability or job loss.

These features, combined with positive Scotiabank car loan customer reviews, highlight the loan’s user-friendly design and customer satisfaction.

Special Programs for Diverse Borrowers

Scotiabank caters to unique borrower needs with tailored programs:

- Grad Auto Loan: For recent or soon-to-graduate college/university students, allowing financing up to 90 days before starting a full-time job. Proof of graduation or employment is required.

- Newcomer Automotive Loan: For those in Canada less than 3 years, with relaxed credit history requirements. Permanent residents need a 10% down payment; foreign workers require 25%.

These programs make Scotiabank new car loan Canada accessible to a broader audience, supporting diverse financial situations.

Comparing Best Car Loan Rates Scotiabank Canada with Alternatives

To ensure you’re getting the best car loan rates Scotiabank Canada, compare with other options. The Financial Consumer Agency of Canada notes that dealership loans may involve manufacturer financing, banks, or independent lenders, while direct bank loans might offer better rates for established clients. Leasing, typically 3-5 years, provides lower payments but no ownership, with potential costs for wear and tear. Rent-to-own plans offer similar flexibility but may include higher overall costs. Scotiabank’s rates (6.99% for new cars) are competitive, though some promotional offers from other lenders may reach 0%, often with restrictions. Use comparison tools or consult a financial advisor to find the best fit.

Using the Scotiabank Car Loan Calculator Canada

The Scotiabank car loan calculator Canada is a valuable tool for estimating payments. Input the loan amount, down payment, term, and estimated interest rate to see monthly costs. For example, a $40,000 loan with a 10% down payment over 72 months at 6.99% might result in payments of about $600. This tool, available on Scotiabank’s website, helps plan your budget effectively.

Tips for Securing the Best Loan Deal

To maximize the value of your Scotiabank new car loan Canada:

- Check Your Credit: A score of 680+ secures better rates; improve your score before applying if possible.

- Compare Rates: Review offers from multiple lenders, noting terms and fees.

- Use the Calculator: Estimate payments to ensure affordability.

- Negotiate at Dealerships: Leverage Scotiabank’s financing to negotiate better vehicle prices.

- Consider Pre-Approval: Scotiabank car loan pre approval clarifies your budget, strengthening your bargaining position.

For additional resources, explore Quick Approvals Canada.

Q&A Section

1. What is the interest rate for Scotiabank new car loan?

The starting rate is 6.99% for new cars, varying by credit score, loan amount, and term. Use Scotiabank’s auto loan calculator at their website for precise estimates.

2. How to apply for Scotiabank car loan online?

Visit Scotiabank’s auto loan page, click “Apply Now,” and submit personal and financial details. Approval typically takes 1-3 business days, with pre-approval valid for 30 days. Check Quick Approvals Canada for streamlined application support.

3. What are the requirements for Scotiabank car loan for new cars?

You need Canadian residency, stable income, and documents like proof of income, address, and vehicle details. A credit score of 680+ is ideal for the best rates.

4. Does Scotiabank offer pre-approval for car loans?

Yes, Scotiabank car loan pre approval is available online or by phone, valid for 30 days, helping you shop confidently within your budget.

5. Are there any fees associated with Scotiabank car loans?

No application or prepayment fees apply, but an origination fee up to $300 and late payment fees may occur. Always review terms before signing.

6. Can I get a Scotiabank car loan for electric vehicles?

Yes, Scotiabank car loan for electric vehicles supports eco-friendly purchases, potentially with special rates or incentives, aligning with Canada’s push for sustainable transport.

Conclusion

The Scotiabank new car loan Canada is a versatile and competitive option for financing your new vehicle. With rates starting at 6.99%, flexible terms up to 8 years, and features like payment breaks and online management, it caters to diverse borrowers. Positive Scotiabank car loan customer reviews highlight its flexibility and customer service, making it a trusted choice. Whether you’re a newcomer, graduate, or eco-conscious buyer, Scotiabank’s programs and tools like the Scotiabank car loan calculator Canada simplify the process. For more details, visit Scotiabank’s website or explore financing options at Quick Approvals Canada. Compare rates and terms to ensure the best fit for your budget, and drive away with confidence.