In today’s fast-paced world, owning a car is often a necessity, but financing one requires careful planning. The monthly car loan payment calculator Canada is an essential tool for Canadians looking to estimate their car loan payments accurately. Whether you’re eyeing a sleek sedan or a rugged SUV, understanding your monthly payments helps you budget effectively and avoid financial strain.

By using resources like Quick Approvals, you can access user-friendly calculators to simplify this process. This article dives deep into how these calculators work, their benefits, and tips for securing the best auto loan terms in Canada, with insights from authoritative sources like government and bank websites.

What Is a Monthly Car Loan Payment Calculator Canada?

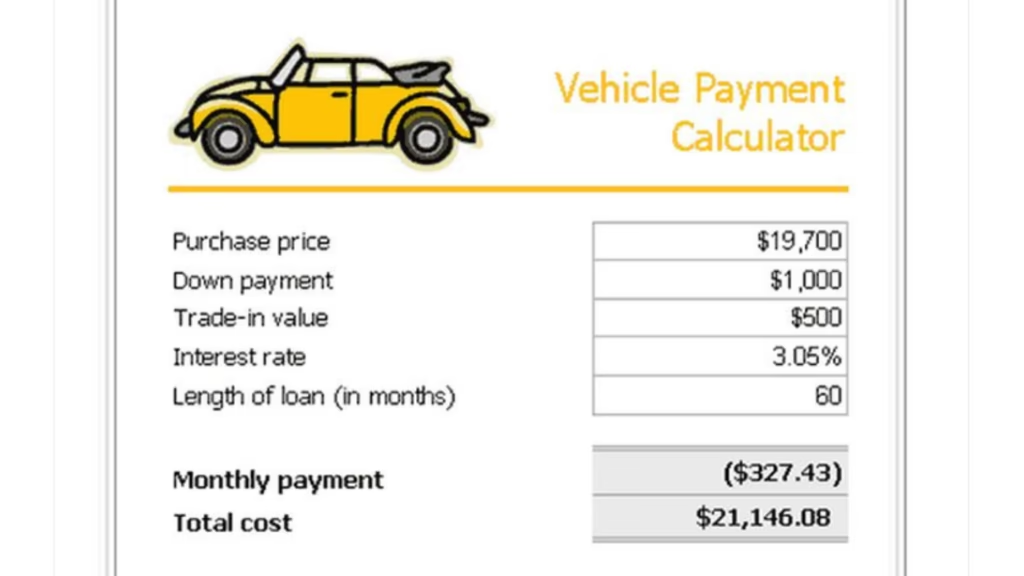

A monthly car loan payment calculator Canada is an online tool designed to estimate your monthly auto loan payments based on key inputs like loan amount, interest rate, and loan term. These calculators are invaluable for Canadians who want to make informed decisions about car financing without diving into complex math. By entering details such as the vehicle’s price, down payment, and loan duration, you can quickly see how much you’ll pay each month.

- Accuracy: Provides precise estimates based on your inputs.

- Speed: Delivers results instantly, saving time compared to manual calculations.

- Flexibility: Allows you to adjust variables to see how changes affect payments.

According to the Government of Canada’s Financial Consumer Agency, understanding loan terms is critical to avoiding unexpected costs, making these calculators a must-have tool.

How to Calculate Monthly Auto Loan Payment Canada

Calculating your monthly auto loan payment manually involves a complex formula, but a monthly car loan payment calculator Canada simplifies the process. The formula considers the principal (loan amount), interest rate, and loan term. Here’s a breakdown of the key factors:

- Principal: The amount you borrow after subtracting your down payment.

- Interest Rate: The annual percentage rate (APR) charged by the lender.

- Loan Term: The duration of the loan, typically 36 to 84 months.

To calculate manually, you’d use the formula: \[ M = P \times \frac{r(1+r)^n}{(1+r)^n – 1} \] Where: – \( M \) = Monthly payment – \( P \) = Principal loan amount – \( r \) = Monthly interest rate (annual rate ÷ 12) – \( n \) = Number of payments (loan term in months) However, tools like those on Quick Approvals automate this process, letting you focus on comparing loan options.

Why Use a Best Auto Loan Calculator for Canada?

Not all calculators are created equal. A best auto loan calculator for Canada offers features tailored to the Canadian market, such as accounting for local taxes (e.g., GST, PST) and interest rates offered by Canadian lenders. These calculators often include:

- Tax adjustments for provinces like Ontario or British Columbia.

- Options to factor in trade-in values or additional fees.

- Comparisons of fixed vs. variable interest rates.

best auto loan calculator for Canada, Using a high-quality calculator ensures you get a realistic estimate, helping you avoid surprises when finalizing your loan. Data from competitor sites like Ratehub suggests that top calculators also allow you to explore different loan terms to find the most affordable option.

Factors That Affect What Is the Monthly Payment for Auto Loan Canada

Several factors influence your what is the monthly payment for auto loan Canada. Understanding these can help you optimize your loan terms:

| Factor | Impact on Monthly Payment |

|---|---|

| Loan Amount | Higher loans increase monthly payments. |

| Interest Rate | Higher rates lead to costlier payments. |

| Loan Term | Longer terms reduce monthly payments but increase total interest. |

| Down Payment | Larger down payments lower the loan amount and payments. |

| Credit Score | Better scores secure lower interest rates. |

what is the monthly payment for auto loan Canada, The Royal Bank of Canada emphasizes that improving your credit score before applying for a loan can significantly reduce your interest rate, lowering your monthly payments.

Benefits of a Free Monthly Auto Loan Calculator Canada

A free monthly auto loan calculator Canada is accessible to everyone and provides instant insights without requiring a financial advisor. These tools are especially useful for:

- Budget Planning: Helps you determine if a car fits your financial goals.

- Comparing Offers

- Transparency: Shows how interest and term length impact costs.

free monthly auto loan calculator Canada, Sites like Quick Approvals offer free calculators that are user-friendly and tailored to Canadian borrowers, making financial planning straightforward.

Exploring Car Financing Monthly Payment Calculator Canada Options

A car financing monthly payment calculator Canada goes beyond basic calculations by incorporating additional costs like taxes, insurance, and maintenance. These calculators are ideal for buyers who want a holistic view of car ownership costs. For example, in provinces like Ontario, HST (13%) can significantly impact the total loan amount. Insights from competitor sites like Car Loans Canada highlight that comprehensive calculators also allow you to input optional add-ons like extended warranties.

Seasonal Trends in Canada Monthly Payment Calculator for Car Loans

Search trends for Canada monthly payment calculator for car loans often peak in spring (April-June) when Canadians are more likely to purchase vehicles due to tax refunds or seasonal promotions. Data from tools like Google Trends shows increased interest during these months, making it a great time to use calculators to compare deals. Dealerships may also offer lower rates during this period, so running multiple scenarios through a calculator can help you capitalize on these opportunities.

Auto Loan Monthly Payment Estimator Canada: How It Works

An auto loan monthly payment estimator Canada is similar to a calculator but often includes simplified interfaces for quick estimates. These tools are perfect for first-time buyers who may not know exact loan terms yet. By inputting an estimated loan amount and interest rate, you can get a ballpark figure to guide your car shopping. For precise calculations, always verify with a detailed calculator or lender.

Tips for Using a Best Online Calculator for Car Loan Payments Canada

To maximize the benefits of a best online calculator for car loan payments Canada, follow these tips:

- Input Accurate Data: Use realistic figures for loan amount, interest rate, and term.

- Compare Scenarios: Test different loan terms (e.g., 48 vs. 60 months) to find the best balance.

- Check Local Taxes: Ensure the calculator accounts for provincial taxes.

- Verify Interest Rates: Use current rates from Canadian banks for accuracy.

Resources like Quick Approvals provide calculators that let you adjust these variables easily, ensuring you get tailored results.

Q&A: Common Questions About Monthly Car Loan Payment Calculator Canada

How Do I Calculate My Car Loan Payment in Canada?

Calculating your car loan payment in Canada involves entering the loan amount, interest rate, and term into a monthly car loan payment calculator Canada. For example, a $20,000 loan with a 5% interest rate over 60 months results in approximately $377 per month. Use tools from trusted sources like the Government of Canada to understand loan terms better.

What Factors Affect Monthly Auto Loan Payments in Canada?

Several factors impact your what factors affect monthly auto loan payments in Canada, including loan amount, interest rate, loan term, down payment, and credit score. A larger down payment or shorter term reduces monthly payments, while a higher interest rate increases them. Improving your credit score before applying can secure better rates, as noted by major banks like RBC.

How Much Is Monthly Car Payment Calculator Canada?

The amount of your monthly car payment depends on the loan details. For instance, a $30,000 loan at 4% interest over 72 months might result in payments of around $475. Using a monthly car loan payment calculator Canada helps you estimate this based on your specific loan terms.

How to Use Auto Loan Payment Calculator for Canada?

To use an how to use auto loan payment calculator for Canada, input the loan amount, interest rate, term, and any down payment. Adjust for taxes or fees if applicable. Calculators on sites like Quick Approvals guide you through the process with clear prompts, ensuring accurate results.

Calculate Car Loan Payments Monthly in Canada: What to Know?

When you calculate car loan payments monthly in Canada, consider additional costs like taxes, insurance, and maintenance. A comprehensive calculator accounts for these, providing a clearer picture of your total expenses. Always double-check interest rates and terms with your lender for accuracy.

Conclusion

The monthly car loan payment calculator Canada is a powerful tool for anyone looking to finance a vehicle in Canada. By understanding how to use these calculators, exploring factors like interest rates and loan terms, and comparing options, you can make informed decisions that fit your budget. Whether you’re a first-time buyer or refinancing an existing loan, tools like those on Quick Approvals simplify the process. For further insights, explore authoritative resources like the Government of Canada’s financial guides or major bank websites to stay informed about loan terms and rates. Start calculating today to drive away with confidence!