Navigating the process of financing a vehicle in Canada can be daunting, but understanding how to calculate car loan payments in Canada is a critical step toward making informed financial decisions. Whether you’re eyeing a sleek sedan or a rugged SUV, knowing the ins and outs of your monthly payments helps you budget effectively and avoid surprises.

This comprehensive guide breaks down the process, from formulas to practical tools, ensuring you can confidently manage your car loan. For personalized tools and insights, explore resources like Quick Approvals, which offers tailored solutions for Canadian borrowers. We’ll also draw on authoritative sources, such as government and bank websites, to provide accurate and actionable advice.

Car Loan Calculation Formula Canada: The Basics

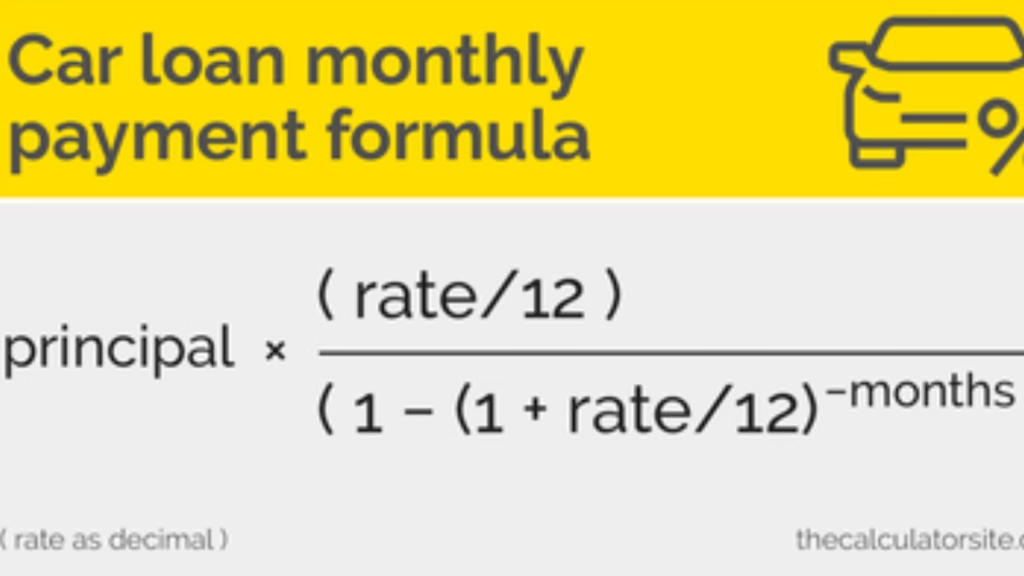

At the heart of understanding how to calculate car loan payments in Canada lies the car loan payment formula. This mathematical approach accounts for the principal loan amount, interest rate, and loan term to determine your monthly payment. The standard formula for a fixed-rate car loan is:

M = P [r(1+r)^n] / [(1+r)^n – 1]

- M: Monthly payment

- P: Principal loan amount (vehicle price minus down payment)

- r: Monthly interest rate (annual rate divided by 12)

- n: Number of monthly payments (loan term in months)

For example, if you borrow $30,000 at a 5% annual interest rate for 60 months, the monthly rate is 0.004167 (5% ÷ 12), and the formula yields a monthly payment of approximately $566.14. This straightforward method empowers you to estimate payments manually, ensuring transparency in your financing decisions.

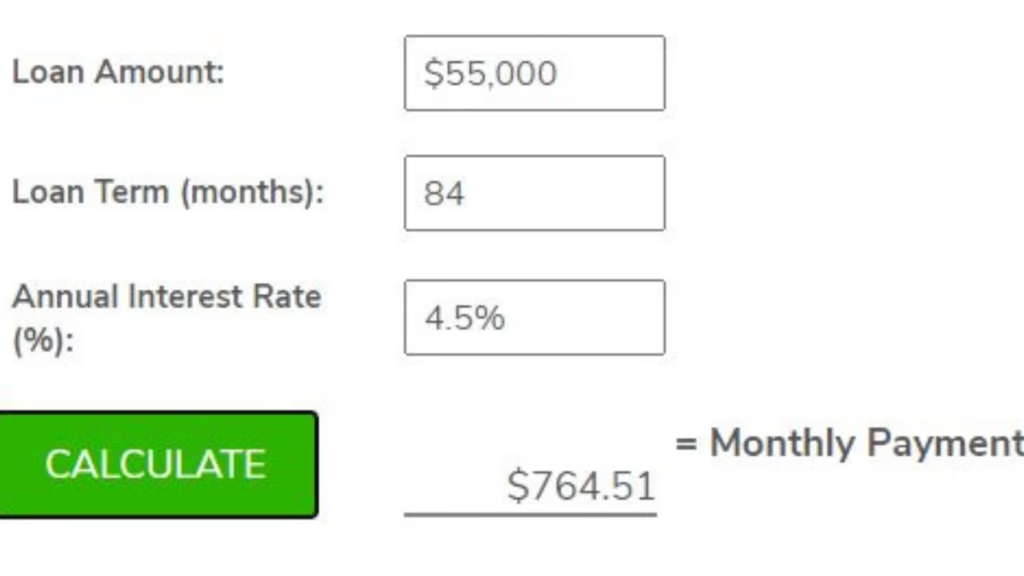

Using a Monthly Car Loan Payment Calculator Canada

For those who prefer a quicker approach, a monthly car loan payment calculator Canada simplifies the process. These online tools, available on platforms like Quick Approvals, allow you to input the loan amount, interest rate, and term to instantly compute your monthly payment. According to the Government of Canada’s Financial Consumer Agency, such calculators help consumers compare loan options and understand the impact of different interest rates or terms.

- Input Accuracy: Ensure your inputs (e.g., interest rate, down payment) reflect current offers from lenders.

- Flexibility: Adjust terms (e.g., 36 vs. 60 months) to see how payments change.

- Additional Costs: Some calculators include taxes or fees, which can refine your estimates.

These tools are particularly useful for Canadians shopping for competitive rates, as they provide instant clarity without manual calculations.

Calculating Car Loan Interest in Canada: What You Need to Know

Interest rates significantly impact your loan’s total cost, making calculating car loan interest in Canada a key skill. Interest is typically calculated as simple or compound, depending on the lender. Most car loans in Canada use simple interest, where interest accrues only on the outstanding principal. To calculate total interest over the loan term:

Total Interest = Principal × Annual Interest Rate × Loan Term (in years)

For a $25,000 loan at 4.5% over 5 years, the total interest would be $25,000 × 0.045 × 5 = $5,625. Divide this by the number of payments to understand its monthly impact. Insights from Canadian bank websites, like the TD Bank, highlight how fixed-rate loans provide predictable payments, while variable rates may fluctuate with market conditions.

Choosing the Best Car Loan Calculator Canada

With numerous online tools available, finding the Best Car Loan Calculator Canada can streamline your planning. Top calculators offer features like amortization schedules, tax inclusion, and biweekly payment options. When evaluating calculators:

- Comprehensive Outputs: Look for tools that show total interest paid and payment breakdowns.

- User-Friendly Interface: Platforms like Quick Approvals provide intuitive interfaces for quick calculations.

- Canadian-Specific Features: Ensure the calculator accounts for provincial taxes (e.g., HST in Ontario).

Using a reliable calculator can help you compare loan offers from banks, credit unions, or dealerships, ensuring you secure the best terms.

Auto Loan Amortization Schedule Canada: Understanding Your Payments

An auto loan amortization schedule Canada details how each payment splits between principal and interest over time. Early payments primarily cover interest, while later ones reduce the principal faster. You can generate an amortization schedule using online tools or spreadsheets. For example:

| Month | Payment | Principal | Interest | Balance |

|---|---|---|---|---|

| 1 | $566.14 | $441.14 | $125.00 | $29,558.86 |

| 2 | $566.14 | $442.98 | $123.16 | $29,115.88 |

| … | … | … | … | … |

This table, based on a $30,000 loan at 5% over 60 months, shows how the balance decreases. Amortization schedules help you plan prepayments to save on interest, a strategy often recommended by financial advisors on Canadian bank websites.

Biweekly vs Monthly Car Loan Payments Canada: Which Is Better?

Choosing between **_biweekly vs monthly car loan payments Canada_** affects your interest costs and payoff timeline. Biweekly payments (every two weeks) result in 26 payments per year, equivalent to 13 monthly payments, allowing you to pay off the loan faster. For a $30,000 loan at 5% over 60 months:

- Monthly: $566.14/month, total interest ~$3,968.

- Biweekly: $283.07/biweekly, total interest ~$3,650, with the loan paid off ~4 months earlier.

Biweekly payments suit those with biweekly paychecks, aligning budgeting with income cycles, as noted in resources from Canadian financial institutions.

Tips for Calculating Car Loan Affordability Canada

Before committing to a loan, use **_tips for calculating car loan affordability Canada_** to ensure payments fit your budget. Key considerations include:

- Debt-to-Income Ratio: Aim for car payments below 15% of your monthly income.

- Total Ownership Costs: Include insurance, maintenance, and fuel (e.g., average insurance in Canada is ~$1,800/year).

- Down Payment: A larger down payment (e.g., 20%) reduces monthly payments and interest.

Resources like Quick Approvals can help you assess affordability by offering tools to estimate payments and compare loan options.

Using Excel to Calculate Car Loan Canada

For those comfortable with spreadsheets, using Excel to calculate car loan Canada offers a customizable approach. Excel’s PMT function simplifies calculations:

=PMT(rate, nper, pv)

- rate: Monthly interest rate (e.g., 5% ÷ 12 = 0.004167).

- nper: Number of payments (e.g., 60 months).

- pv: Present value (loan amount, e.g., $30,000).

For a $30,000 loan at 5% over 60 months, input =PMT(0.05/12, 60, 30000) to get $566.14/month. Excel also supports amortization schedules, letting you track interest and principal over time.

Q&A: Common Questions About How to Calculate Car Loan Payments in Canada

How Much Will My Car Loan Payment Be Canada?

Determining how much will my car loan payment be Canada depends on the loan amount, interest rate, and term. For a $25,000 loan at 4.5% over 48 months, use the loan formula or a calculator to estimate ~$553/month. Tools on Quick Approvals can provide precise figures based on your inputs.

How to Figure Out Car Loan Payments Canada?

To figure out how to figure out car loan payments Canada, you can use the loan formula (M = P [r(1+r)^n] / [(1+r)^n – 1]) or an online calculator. Input the principal, interest rate, and term, and account for taxes or fees. The Government of Canada’s Financial Consumer Agency offers guidance on understanding loan terms.

What Is the Formula for Car Loan Payments Canada?

The what is the formula for car loan payments Canada is M = P [r(1+r)^n] / [(1+r)^n – 1], where M is the monthly payment, P is the principal, r is the monthly interest rate, and n is the number of payments. This formula ensures accurate calculations for fixed-rate loans common in Canada.

What Are the Benefits of Biweekly Payments?

Opting for biweekly vs monthly car loan payments Canada reduces total interest and shortens the loan term. For example, a $20,000 loan at 5% over 60 months saves ~$200 in interest with biweekly payments. This approach aligns with budgeting for many Canadians.

How Can I Lower My Car Loan Payments?

To lower payments, increase your down payment, choose a longer loan term (e.g., 72 months), or secure a lower interest rate. Using a best car loan calculator Canada helps compare options. Always assess affordability to avoid overextending your budget.

Conclusion

Mastering how to calculate car loan payments in Canada empowers you to make informed financing decisions. From using the car loan calculation formula Canada to leveraging tools like a monthly car loan payment calculator Canada, you can plan payments that fit your budget. Exploring auto loan amortization schedule Canada or using Excel to calculate car loan Canada provides deeper insights, while **_tips for calculating car loan affordability Canada_** ensure long-term financial health. For further guidance, authoritative resources like the Government of Canada’s Financial Consumer Agency or bank websites offer valuable information. To explore personalized loan options, visit Quick Approvals for tools and insights tailored to Canadian borrowers.