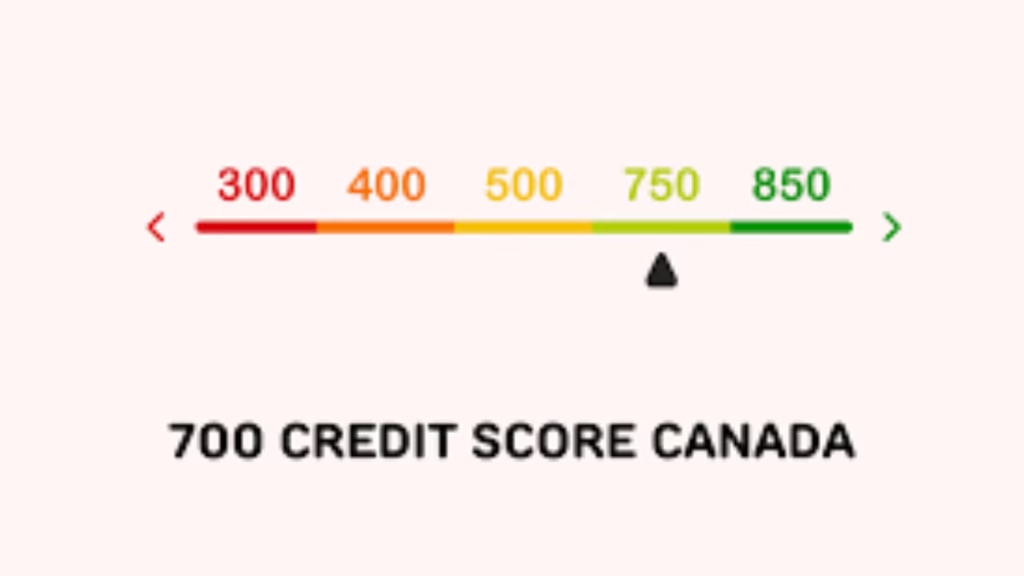

Good credit auto loans above 700 score Canada, Securing a car loan with a credit score above 700 in Canada opens the door to favorable financing options, competitive interest rates, and flexible terms. Good credit auto loans above 700 score Canada are designed for borrowers with strong credit profiles, enabling them to access vehicles with lower borrowing costs.

This comprehensive guide explores the ins and outs of obtaining such loans, leveraging insights from authoritative sources like government and bank websites, and offers practical advice for Canadian borrowers. For personalized assistance, visit Quick Approvals to explore tailored financing solutions.

What Are Best Auto Loans for 700 Credit Score Canada?

Good credit auto loans above 700 score Canada, A credit score above 700 is considered “good” to “excellent” by Canadian lenders, placing borrowers in a prime position to secure best auto loans for 700 credit score Canada. These loans typically come with lower interest rates, higher approval odds, and flexible repayment terms. Lenders, including major banks and credit unions, view a 700+ score as a sign of financial responsibility, reducing their risk and allowing them to offer better deals.

- Lower Interest Rates: Borrowers with good credit often qualify for rates as low as 3-5%, depending on the lender and loan term.

- Higher Loan Amounts: A strong credit score can increase the amount you’re eligible to borrow, ideal for purchasing higher-end vehicles.

- Flexible Terms: Loan terms can range from 36 to 84 months, giving borrowers flexibility to manage monthly payments.

best auto loans for 700 credit score Canada, For official insights on credit scores and borrowing, check the Government of Canada’s credit report guide.

Exploring Auto Loan Rates for Credit Score Above 700 Canada

Interest rates are a critical factor when considering auto loan rates for credit score above 700 Canada. With a credit score above 700, you’re likely to qualify for some of the most competitive rates available. For instance, major banks like RBC and TD often offer rates between 3.5% and 5.5% for borrowers with strong credit, while credit unions may provide even lower rates for members.

Rates fluctuate based on: auto loan rates for credit score above 700 Canada

- Loan Term: Shorter terms (e.g., 36 months) typically have lower rates but higher monthly payments.

- Vehicle Type: New vehicles often qualify for lower rates than used ones.

- Economic Conditions: Bank of Canada’s policies, like recent rate hikes, can influence auto loan rates.

Data from competitor websites indicates that rates for good credit borrowers have remained competitive in 2025, with some lenders offering promotional rates during spring and summer. Always compare offers from multiple lenders to secure the best deal.

How to Get Car Loan with Good Credit in Canada

Securing a car loan with a credit score above 700 involves a straightforward process, but preparation is key to maximizing benefits. Here’s a step-by-step guide to navigate how to get car loan with good credit in Canada:

- Check Your Credit Score: Obtain your credit report from Equifax or TransUnion to confirm your score is above 700.

- Research Lenders: Compare offers from banks, credit unions, and online lenders like Quick Approvals.

- Gather Documentation: Prepare proof of income, employment, and identity to streamline the application process.

- Negotiate Terms: Use your strong credit to negotiate lower rates or better terms.

- Finalize the Loan: Review the loan agreement carefully before signing.

how to get car loan with good credit in Canada, This process ensures you leverage your credit strength effectively, avoiding common pitfalls like overlooking hidden fees.

Comparing Best Banks for Auto Loans with Good Credit Canada

Choosing the right lender is crucial for securing best banks for auto loans with good credit Canada. Major Canadian banks and credit unions offer tailored products for borrowers with high credit scores. Below is a comparison of popular options based on market research:

| Lender | Interest Rate Range | Loan Term Options | Key Features |

|---|---|---|---|

| RBC | 3.5%–5.5% | 36–84 months | Flexible terms, online application |

| TD | 3.7%–5.8% | 36–72 months | Pre-approval available |

| Scotiabank | 3.9%–6.0% | 36–84 months | Dealer partnerships for quick processing |

| Credit Unions | 3.0%–5.0% | 24–84 months | Lower rates for members, personalized service |

Visit the RBC Car Loan page for detailed information on their offerings. Credit unions often provide the lowest rates but may require membership, so explore local options in your province.

Benefits of Low Interest Auto Loans for Good Credit Canada

Low interest auto loans for good credit Canada are a major advantage for borrowers with scores above 700. These loans reduce the overall cost of financing, making vehicle ownership more affordable. Key benefits include:

- Lower Total Cost: A 1% rate reduction on a $30,000 loan can save thousands over the loan term.

- Faster Payoff: Lower rates allow for shorter terms without inflating monthly payments.

- Better Negotiation Power: Good credit gives you leverage to negotiate with dealers and lenders.

Competitor data suggests that borrowers with good credit often secure promotional rates during seasonal sales, particularly in spring and fall. Always review the fine print for prepayment penalties or additional fees.

Understanding Car Financing Options for High Credit Score Canada

Borrowers with high credit scores have access to diverse car financing options for high credit score Canada. Beyond traditional bank loans, options include:

- Dealership Financing: Many dealers partner with banks to offer competitive rates for good credit borrowers.

- Leasing: Leasing can be cost-effective for those who prefer lower monthly payments and plan to upgrade vehicles frequently.

- Manufacturer Financing: Brands like Toyota or Ford occasionally offer 0%–2% financing for high-credit buyers during promotions.

Each option has trade-offs. For example, leasing may limit mileage, while manufacturer financing often requires a shorter loan term. Evaluate your driving habits and financial goals before deciding.

Auto Loan Approval Process for Good Credit Canada

The auto loan approval process for good credit Canada is typically faster and smoother than for lower credit scores. Lenders prioritize applicants with scores above 700, often approving loans within 24–48 hours. Key steps include:

- Pre-Approval: Many lenders offer pre-approval, allowing you to shop with a set budget.

- Application Submission: Provide financial details, including income and credit history.

- Credit Check: Lenders perform a hard inquiry, which may slightly impact your score.

- Loan Offer: Receive terms, including rate, amount, and repayment period.

- Vehicle Selection: Choose a vehicle within your approved loan amount.

For a seamless experience, platforms like Quick Approvals can connect you with lenders offering competitive terms.

Q&A: Common Questions About Good Credit Auto Loans Above 700 Score Canada

1. What Is the Best Car Loan for 700 Credit Score Canada?

Finding the what is the best car loan for 700 credit score Canada depends on your priorities, such as low interest rates or flexible terms. Banks like RBC and credit unions offer rates as low as 3.0%–5.0% for borrowers with a 700+ score. Compare offers from multiple lenders, focusing on total loan cost and repayment flexibility. For official guidance, the Government of Canada’s borrowing guide provides valuable insights.

2. How Much Can I Borrow for Car Loan with 700 Score Canada?

The amount you can borrow with a how much can i borrow for car loan with 700 score Canada query depends on your income, debt-to-income ratio, and lender policies. With a 700+ score, borrowers can typically secure loans up to $50,000 or more, especially for new vehicles. Use a loan calculator to estimate based on your monthly budget and desired term.

3. Is 700 a Good Credit Score for Auto Loan Canada?

Yes, a 700 credit score is considered good for an auto loan in Canada. Is 700 a good credit score for auto loan Canada is a common question, and the answer is that it qualifies you for competitive rates (3.5%–5.5%) and higher loan amounts. Maintaining a score above 700 ensures better terms and faster approvals.

4. How Do I Qualify for Low Interest Auto Loans for Good Credit Canada?

To qualify for low interest auto loans for good credit Canada, maintain a credit score above 700, provide proof of stable income, and keep your debt-to-income ratio low. Shop around during promotional periods, as lenders often offer discounted rates in spring or fall. Platforms like Quick Approvals can help you compare offers efficiently.

5. What Are the Best Car Financing Options for High Credit Score Canada?

Car financing options for high credit score Canada include bank loans, dealership financing, leasing, and manufacturer promotions. For example, banks like TD offer flexible terms, while manufacturers like Honda may provide low-rate financing for high-credit buyers. Evaluate each option based on your long-term financial goals.

Conclusion

Navigating good credit auto loans above 700 score Canada offers borrowers with strong credit profiles an opportunity to secure affordable, flexible financing. By leveraging competitive rates, exploring diverse financing options, and choosing reputable lenders, you can drive away in your desired vehicle without breaking the bank. Key steps include comparing offers, understanding loan terms, and preparing documentation to streamline the process. For further insights, explore resources like the Government of Canada’s financial guides or connect with trusted platforms like Quick Approvals to find tailored solutions. Start your journey today and make informed decisions to achieve your automotive and financial goals.