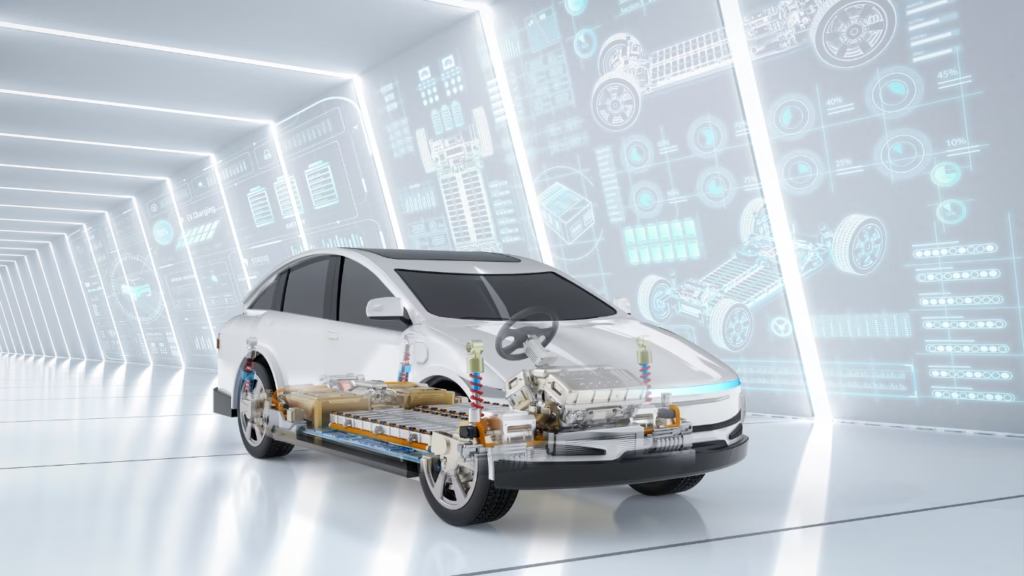

The rise in popularity of car loans for hybrid cars in Canada reflects growing consumer interest in eco-friendly and fuel-efficient vehicles. Hybrid cars, which combine traditional gasoline engines with electric motors, offer significant savings on fuel and reduced environmental impact, making them an attractive option for Canadian drivers.

However, purchasing a hybrid car often requires financing, and understanding the available options is key to making an informed decision. This comprehensive guide explores hybrid car financing in Canada, covering loan options, interest rates, government incentives, and practical steps to secure the best terms. As of June 2025, the average car loan interest rate in Canada is approximately 6.86%, according to Statistics Canada.

However, some lenders offer low interest hybrid car loans in Canada, particularly for eco-friendly vehicles, which can make financing more affordable. While the federal Incentives for Zero-Emission Vehicles (iZEV) program is currently paused, many provinces provide rebates that can lower the cost of hybrid car ownership. For tailored financing solutions, visit quickapprovals.ca, a trusted resource for finding competitive loan offers.

Understanding Hybrid Car Financing in Canada

Hybrid cars are designed to optimize fuel efficiency by switching between gasoline and electric power, making them a popular choice for environmentally conscious Canadians. Financing a hybrid car through a car loan for hybrid cars in Canada involves borrowing funds from a lender—such as a bank, credit union, or dealership—and repaying the loan over a set period, typically 24 to 84 months. The terms of the loan, including interest rates and monthly payments, depend on factors like your credit score, income, down payment, and the vehicle’s value.

Lenders assess borrowers based on their financial profile. A strong credit score (typically 670 or higher) can secure low interest hybrid car loans in Canada, while a larger down payment reduces the loan amount and interest costs. Some banks, like CIBC, offer special financing rates for hybrid and electric vehicles, which can be explored at CIBC’s Electric Vehicle Loan page. Dealerships may also provide promotional rates, sometimes as low as 0% for select models, though these offers are often time-limited and model-specific.

Benefits of Financing a Hybrid Car

Financing a hybrid car offers multiple advantages, making hybrid car loans in Canada a compelling choice for many buyers. Here are the key benefits:

- Fuel Efficiency: Hybrids consume less fuel than traditional vehicles, leading to significant savings, especially with rising gas prices.

- Environmental Impact: By reducing emissions, hybrids contribute to Canada’s sustainability goals, appealing to eco-conscious drivers.

- Potential Incentives: Although the federal iZEV program is paused, provincial rebates, such as Quebec’s up to $7,000 for plug-in hybrids, can lower costs.

- Resale Value: Hybrids often retain their value better than conventional cars, offering long-term financial benefits.

These advantages make car loans for hybrid cars in Canada an attractive option for those looking to balance cost, performance, and environmental responsibility.

How to Secure the Best Car Loans for Hybrid Cars in Canada

Finding the best car loans for hybrid cars in Canada requires strategic planning. Here are practical steps to ensure you get the most favorable terms:

- Check Your Credit Score: A higher credit score can unlock lower interest rates. If your score is below 670, consider improving it by paying down debt or correcting errors on your credit report.

- Compare Rates and Terms: Interest rates vary by lender. For example, banks like RBC and TD offer competitive rates, while dealerships may have promotional offers. Use comparison tools at quickapprovals.ca to evaluate options.

- Get Pre-Approved: Pre-approval from a bank or credit union provides a clear budget and strengthens your negotiating power at dealerships.

- Look for Special Offers: Some lenders, like CIBC, provide low interest hybrid car loans in Canada for eco-friendly vehicles. Check for seasonal promotions, such as 0% financing from manufacturers like Subaru or Toyota.

Using a hybrid car loan calculator in Canada can help estimate monthly payments based on loan amount, interest rate, and term, ensuring you choose a loan that fits your budget.

Popular Hybrid Cars in Canada for 2025

The Canadian market offers a range of hybrid cars that balance affordability, efficiency, and performance. Below is a comparison of some top models for 2025, based on data from industry sources:

| Model | Starting Price | Fuel Efficiency (City/Highway) | Key Features |

|---|---|---|---|

| Toyota Corolla Hybrid | $24,760 | 5.0 L/100 km / 4.6 L/100 km | Affordable, spacious, reliable |

| Toyota RAV4 Hybrid | $32,000 | 6.0 L/100 km / 6.4 L/100 km | Versatile SUV, all-wheel drive |

| Honda CR-V Hybrid | $33,000 | 5.7 L/100 km / 6.4 L/100 km | Comfortable, family-friendly |

| Ford Escape Hybrid | $32,000 | 5.5 L/100 km / 6.0 L/100 km | Strong performance, tech-savvy |

| Hyundai Tucson Hybrid | $33,000 | 5.5 L/100 km / 5.8 L/100 km | Modern design, advanced features |

These models are among the best hybrid cars in Canada for 2025, offering options for various budgets and preferences. The Toyota Corolla Hybrid, for instance, is the most affordable, while the Ford Escape Hybrid appeals to those seeking performance.

Government Incentives for Hybrid Car Loans in Canada

Government incentives can make hybrid cars more affordable. The federal iZEV program, which offered up to $5,000 for plug-in hybrids with an electric range of 50 km or more, is paused as of January 2025 due to depleted funding. However, provincial incentives remain available in several regions:

- British Columbia: Offers rebates for plug-in hybrids and electric vehicles, plus charger installation incentives (up to $350 for home chargers).

- Quebec: Provides up to $7,000 for plug-in hybrids through the Écocamionnage program.

- Prince Edward Island: Offers $2,000 for plug-in hybrids, though Tesla models are ineligible as of March 2025.

- New Brunswick: Provides rebates until July 1, 2025, for qualifying vehicles.

For the latest details, check provincial government websites or visit Transport Canada for updates on federal programs. These government incentives for hybrid car loans in Canada can significantly reduce the upfront cost of ownership.

Financing Options from Banks and Credit Unions

Several Canadian banks and credit unions offer competitive car loan rates for hybrid cars in Canada. Notable options include:

- CIBC: Provides special financing rates for hybrid and electric vehicles through partnered dealerships, often lower than the 6.86% average (CIBC Electric Vehicle Loan).

- RBC: Offers flexible auto loans with terms up to 96 months, suitable for hybrid purchases.

- TD Bank: Provides financing for new and used vehicles, including hybrids, with customizable repayment plans.

- Scotiabank: Known for competitive rates and quick approval processes for auto loans.

When comparing lenders, consider interest rates, loan terms, and fees. Some banks offer low interest hybrid car loans in Canada specifically for eco-friendly vehicles, so inquire about these promotions.

Using a Hybrid Car Loan Calculator in Canada

A hybrid car loan calculator in Canada is an essential tool for budgeting. These calculators, available on bank websites like CIBC’s, allow you to input the loan amount, interest rate, and term to estimate monthly payments. For example, financing a $30,000 hybrid car at 6.86% over 60 months results in monthly payments of approximately $594, assuming no down payment. Adjusting the term or rate can significantly alter payments, helping you find a loan that fits your financial situation.

To use a calculator effectively:

- Enter the vehicle’s purchase price.

- Input your down payment amount.

- Select a repayment term (e.g., 48 or 60 months).

- Estimate the interest rate, considering special offers for hybrids.

This tool helps you plan for car loans for hybrid cars in Canada with confidence.

How to Apply for a Hybrid Car Loan in Canada

Applying for a hybrid car loan in Canada follows a straightforward process:

- Choose Your Vehicle: Select a hybrid model that fits your needs and budget, such as the Toyota RAV4 Hybrid or Honda CR-V Hybrid.

- Check Your Credit: A score of 670 or higher improves your chances of securing low interest hybrid car loans in Canada. Address any credit issues beforehand.

- Gather Documents: Prepare proof of income, identification, and a down payment (typically 10–20% of the vehicle’s price).

- Get Pre-Approved: Apply for pre-approval from a bank or credit union to know your loan amount and rate.

- Negotiate at Dealerships: Use pre-approval to compare dealership financing offers, which may include promotional rates.

- Finalize the Loan: Sign the loan agreement and complete the purchase.

This process ensures you secure the best car loans for hybrid cars in Canada tailored to your needs.

What Are the Eligibility Criteria for Hybrid Car Loans in Canada?

Eligibility for car loans for hybrid cars in Canada typically includes:

- Credit Score: A score of 670 or higher is ideal, though some lenders offer options for lower scores at higher rates.

- Income: Proof of stable income, such as pay stubs or tax returns, is required.

- Down Payment: Most lenders require 10–20% of the vehicle’s price, though some offer no-down-payment options.

- Residency: You must be a Canadian resident with valid identification.

Lenders may have additional requirements, so check with specific institutions like CIBC or Scotiabank for details.

Are There Special Financing Options for Hybrid Cars in Canada?

Yes, some lenders offer special financing options for hybrid cars in Canada. For example, CIBC provides lower rates for hybrid and electric vehicles through partnered dealerships. Manufacturers like Toyota and Subaru occasionally offer 0% financing for select hybrid models, especially during promotional periods like year-end sales. These offers can significantly reduce the cost of hybrid car financing in Canada, so always inquire about eco-friendly vehicle promotions.

FAQ: Hybrid Car Loans in Canada

Q: What is the interest rate for hybrid car loans in Canada?

A: As of June 2025, the average interest rate for car loans for hybrid cars in Canada is around 6.86%, per Statistics Canada. However, special rates for hybrids can be lower, sometimes 3–5% through banks like CIBC (CIBC Electric Vehicle Loan) or promotional offers from manufacturers.

Q: Are there any government incentives for buying a hybrid car in Canada?

A: The federal iZEV program is paused as of January 2025, but provincial incentives, such as Quebec’s $7,000 rebate for plug-in hybrids, are available. Check Transport Canada for federal updates and provincial websites for local programs.

Q: How can I qualify for a hybrid car loan in Canada?

A: To qualify for a hybrid car loan in Canada, you need a good credit score (ideally 670+), stable income, and often a down payment. Requirements vary by lender, so compare options from banks, credit unions, and dealerships.

Q: What are some popular hybrid cars available in Canada for 2025?

A: Top models include the Toyota Corolla Hybrid ($24,760), Toyota RAV4 Hybrid ($32,000), Honda CR-V Hybrid ($33,000), Ford Escape Hybrid ($32,000), and Hyundai Tucson Hybrid ($33,000), known for their efficiency and affordability.

Q: Is it better to finance a hybrid car through a dealership or a bank?

A: It depends on the terms. Dealerships may offer promotional rates, but banks like RBC or TD often provide low interest hybrid car loans in Canada with flexible terms. Get pre-approved to compare offers effectively.

Conclusion

Securing a car loan for hybrid cars in Canada is a practical way to own an eco-friendly vehicle while managing costs. By comparing car loan rates for hybrid cars in Canada, leveraging tools like a hybrid car loan calculator in Canada, and exploring provincial incentives, buyers can make informed decisions. Resources like quickapprovals.ca offer personalized loan options, while checking provincial websites ensures you stay updated on government incentives for hybrid car loans in Canada. With careful planning, financing a hybrid car can be a rewarding step toward sustainability and savings.