A car loan approval with 750 credit score in Canada is a significant milestone for many Canadians looking to finance a vehicle. With a credit score of 750, you’re in an excellent position to secure favorable loan terms, including competitive interest rates and flexible repayment options.

car loan approval with 750 credit score in Canada, This guide explores the nuances of obtaining a car loan with a strong credit score in Canada, offering insights into requirements, lender options, and strategies to maximize approval chances. For reliable resources, consider exploring Quick Approvals and authoritative sources like government and bank websites for additional information.

What Does a 750 Credit Score Mean for Car Loan Approval in Canada?

A credit score of 750 is considered excellent in Canada, placing you in a prime borrower category. This score reflects a strong history of financial responsibility, including timely bill payments and low credit utilization. Lenders view this score as low-risk, which can lead to better terms for car loan approval with 750 credit score in Canada.

Key Benefits of a 750 Credit Score

- Lower Interest Rates: Borrowers with high credit scores often qualify for the best interest rates for car loan with 750 score Canada, reducing the overall cost of the loan.

- Higher Approval Odds: A 750 score increases your chances of getting car loan with 750 score Canada, as lenders are more confident in your repayment ability.

- Flexible Terms: You may access longer repayment periods or higher loan amounts, making it easier to finance your desired vehicle.

- Negotiation Power: With a strong score, you can negotiate better terms with car loan lenders for 750 credit score in Canada.

According to the Bank of Canada, interest rates for auto loans can vary based on credit profiles, with prime borrowers like those with a 750 score benefiting from rates as low as 4-6% in recent trends.

Car Loan Requirements with 750 Credit Score Canada

Securing a car loan approval with 750 credit score in Canada involves meeting specific lender criteria. While a high credit score is a significant advantage, other factors play a role.

Standard Requirements

- Proof of Income: Lenders typically require proof of stable income, such as pay stubs or tax returns, to ensure you can afford monthly payments.

- Debt-to-Income Ratio: A low ratio (below 40%) demonstrates financial health, boosting approval odds.

- Valid Identification: A driver’s license or other government-issued ID is necessary.

- Down Payment: Many lenders require a down payment (10-20% of the vehicle’s price), though some may offer zero-down options for high credit scores.

- Vehicle Details: Information about the car, including its make, model, and value, impacts loan terms.

For detailed eligibility criteria, the Government of Canada’s financial consumer agency provides resources on auto financing standards.

How to Maximize Your Chances of Getting Car Loan with 750 Score Canada

Even with an excellent credit score, strategic preparation can enhance your approval odds and secure better terms. Here are actionable tips for car loan approval with 750 score Canada:

- Shop Around: Compare offers from multiple car loan lenders for 750 credit score in Canada, including banks, credit unions, and online lenders like Quick Approvals.

- Check Your Credit Report: Ensure there are no errors on your credit report that could affect your score.

- Calculate Affordability: Use a car loan calculator for 750 credit score Canada to estimate monthly payments and stay within budget.

- Negotiate Terms: Leverage your strong credit to negotiate lower rates or waive fees.

- Consider Pre-Approval: Getting pre-approved can streamline the car-buying process and strengthen your position when negotiating with dealers.

Exploring Best Interest Rates for Car Loan with 750 Score Canada

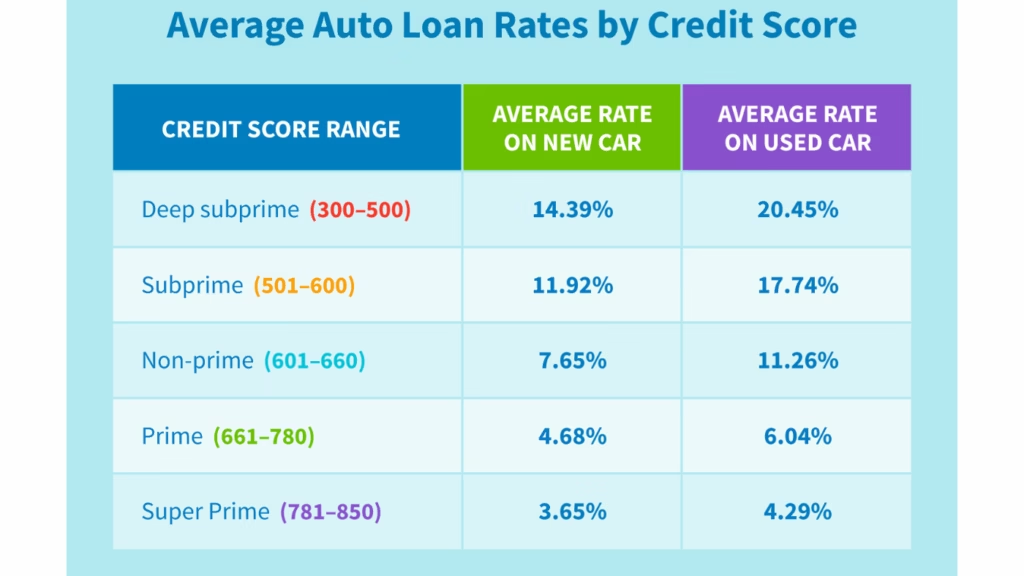

Interest rates are a critical factor in the cost of a car loan. With a 750 credit score, you’re likely to qualify for some of the best interest rates for car loan with 750 score Canada. As of 2025, prime borrowers can expect rates between 4% and 6%, though this varies by lender and loan term.

Factors Influencing Rates

- Loan Term: Shorter terms (e.g., 36 months) often have lower rates than longer terms (e.g., 72 months).

- Lender Type: Credit unions, like Vancity or Meridian, may offer lower rates than traditional banks for high-credit borrowers.

- Market Conditions: Recent Bank of Canada rate hikes have increased borrowing costs, but prime borrowers still secure competitive rates.

- Vehicle Type: New cars typically have lower rates than used cars due to lower risk for lenders.

To explore current rates, check with major Canadian banks or use tools available at Quick Approvals to compare offers.

How to Apply for Car Loan with 750 Credit Canada

The application process for a car loan approval with 750 credit score in Canada is straightforward, especially with a strong credit profile. Here’s a step-by-step guide:

- Research Lenders: Identify car loan lenders for 750 credit score in Canada, such as RBC, TD Bank, or online platforms.

- Gather Documentation: Prepare income proof, ID, and vehicle details.

- Apply Online or In-Person: Many lenders offer online applications for convenience, with quick pre-approval options.

- Review Offers: Compare interest rates, terms, and fees to select the best option.

- Finalize the Loan: Sign the agreement and arrange for funds to be disbursed to the dealer or seller.

Average Car Loan Rate with 750 Credit Canada

The average car loan rate with 750 credit Canada for a 750 credit score typically ranges from 4.5% to 5.5% for new vehicles and slightly higher (5-7%) for used cars, based on data from sources like Ratehub and Loans Canada. These rates reflect the low-risk profile of borrowers with excellent credit.

Rate Comparison Table

| Loan Term | New Car Rate | Used Car Rate |

|---|---|---|

| 36 Months | 4.2-5.0% | 5.0-6.0% |

| 60 Months | 4.5-5.5% | 5.5-6.5% |

| 72 Months | 5.0-6.0% | 6.0-7.0% |

These figures are estimates based on competitor data and may vary by lender. Use a car loan calculator for 750 credit score Canada to get precise monthly payment estimates.

Is 750 Credit Score Good for Car Loan in Canada?

A common question is, is 750 credit score good for car loan in Canada? The answer is a resounding yes. A 750 score is well above the average Canadian credit score (around 650-700), positioning you for favorable loan terms. Lenders view this score as an indicator of reliability, often resulting in:

- Lower interest rates compared to borrowers with scores below 700.

- Access to a wider range of lenders, including premium options.

- Higher loan amounts, answering how much can I borrow for car loan with 750 score Canada.

Can I Get a Car Loan with 750 Credit Score in Canada?

Another frequent concern is, can I get a car loan with 750 credit score in Canada? With a 750 score, approval is highly likely, provided you meet other criteria like income and debt-to-income ratio. Lenders such as Scotiabank and credit unions often prioritize high-credit borrowers, offering streamlined approval processes.

What Is the Best Car Loan for 750 Credit Score in Canada?

Finding the what is the best car loan for 750 credit score in Canada depends on your priorities, such as low rates, flexible terms, or fast approval. Here are top considerations:

- Banks: Major banks like RBC and TD offer competitive rates for prime borrowers.

- Credit Unions: Institutions like Vancity provide personalized terms and lower fees.

- Online Lenders: Platforms like Quick Approvals offer quick applications and tailored options for high-credit borrowers.

Q&A: Common Questions About Car Loan Approval with 750 Credit Score in Canada

1. How to Get Approved for Car Loan with 750 Credit Score in Canada?

To increase your approval chances, ensure all documentation (income proof, ID, etc.) is complete, maintain a low debt-to-income ratio, and compare offers from multiple lenders. Pre-approval can also simplify the process. For more details, check resources at the Government of Canada’s financial consumer agency.

2. Is 750 Credit Score Good for Car Loan in Canada?

Yes, a 750 credit score is excellent for securing a car loan in Canada. It qualifies you for low interest rates and favorable terms, making financing more affordable.

3. Can I Get a Car Loan with 750 Credit Score in Canada?

Absolutely. A 750 score significantly boosts approval odds, as it signals low risk to lenders. Ensure other factors, like income and debt levels, meet lender standards.

4. What Is the Best Car Loan for 750 Credit Score in Canada?

The best loan depends on your needs. Compare rates from banks, credit unions, and online lenders like Quick Approvals to find the lowest rates and best terms.

5. How Much Can I Borrow for Car Loan with 750 Score Canada?

With a 750 score, you can typically borrow up to $50,000 or more, depending on your income and debt-to-income ratio. Use a car loan calculator for 750 credit score Canada to estimate your borrowing capacity.

Conclusion

Securing a car loan approval with 750 credit score in Canada opens the door to competitive rates, flexible terms, and a smooth financing process. By understanding car loan requirements with 750 credit score Canada, comparing best interest rates for car loan with 750 score Canada, and following tips for car loan approval with 750 score Canada, you can confidently navigate the car-buying process. For additional resources, explore authoritative sites like the Government of Canada’s financial consumer agency or compare loan options at Quick Approvals to find the best deal for your needs.